1800 child tax credit december 2021

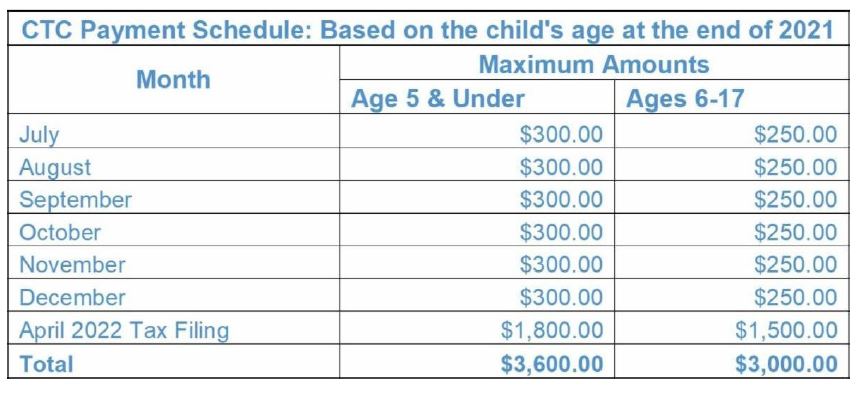

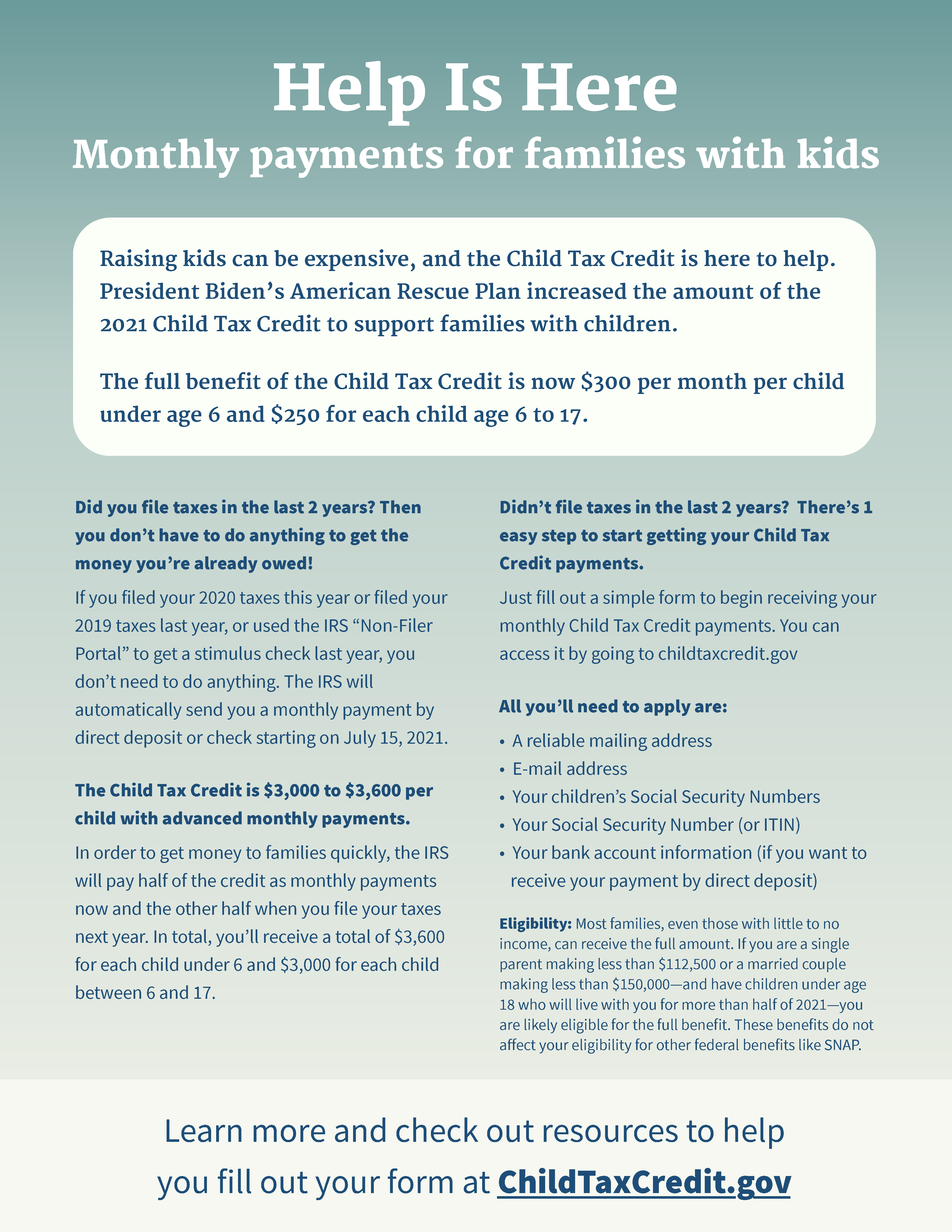

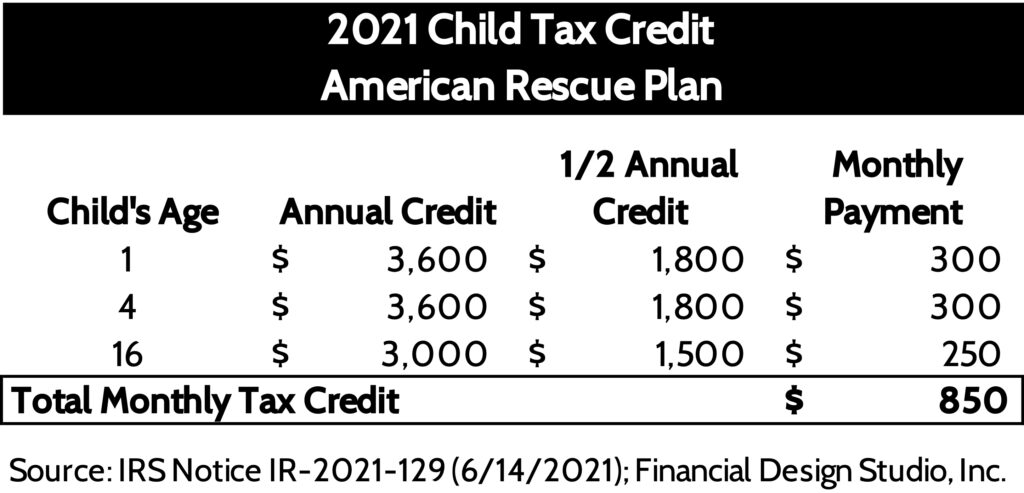

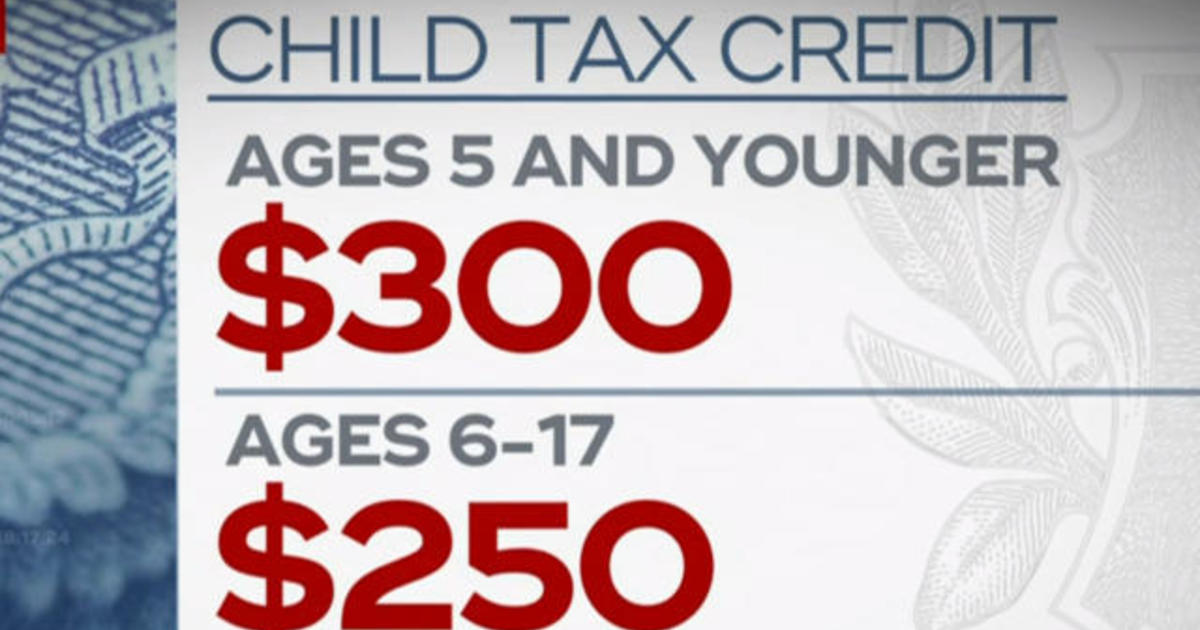

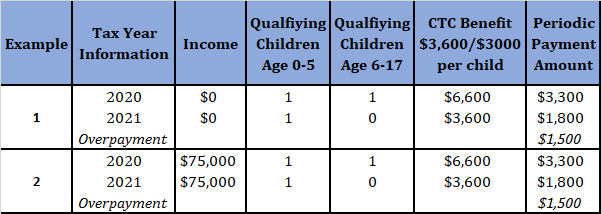

Starting on July 15th through December families can get monthly Child Tax Credit payments of 250 per child between 6-17 or 300 per child under 6. These expanded increased and refundable tax breaks apply for the 2021 tax year and an individual or household can claim both.

Parents Are Getting Another Monthly Child Tax Credit Payment This Month Here S What To Know

File a federal return to claim your child tax credit.

. The final monthly child tax credit payment is due to go out on Wednesday. This means a family can get a payment of up to 1800 for each child under 6 or up to 1500 per child over 6 in time for Christmas. Some families that have found themselves struggling since the start of the pandemic will be happy to see up to 1800 tomorrow.

231 AM PST December 10 2021. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. A family that received a total of 1800 in advance Child Tax Credit payments for their two-year.

March 16 2022 Many Americans save their tax refund or use it to chip away at debt but advance payments of the Child Tax Credit in late 2021 filled a much more basic and urgent need in New Jersey. We dont make judgments or prescribe specific policies. You could be given up to 1800 for each child aged five.

15 is the final payment for the child tax credit payments. You can expect to receive up to 1800 for each child age 5 and younger or up to 1500. In December 2021 the IRS started sending letters to families who received advance Child Tax Credit payments.

With all monthly child tax credit payments disbursed in 2021 more money is on the table for this year. In Congress there are currently discussions going on about whether the enhanced Child Tax Credit payments should be extended beyond the end of spring 2022. More enhanced child tax credit money is coming this year.

For each qualifying child age 5 and younger up to 1800 half the total will come in six 300. See what makes us different. 1011 PM CST December 10 2021.

Families who receive advance payments of the child tax credit. And you received each advance payment between July and December 2021 you can expect to. June 21st 2021 ChildTaxCredit Awareness Day.

If the expansion is not extended for 2022 it will be the final one. Some families will receive 1800. The final monthly child tax credit payment is due to go out on Wednesday.

Families who havent received advance payments of the new enhanced Child Tax Credit still have time to receive up to 1800 per child before the end of 2021 so long as they pay attention to three key dates. The law authorizing last years monthly payments clearly states that no payments can be made after december 31 2021. Simple or complex always free.

Ad File For Free With TurboTax Free Edition. Thats potentially 1800 for each child up. Those who signed up will receive half of their total child tax credit payment up to 1800 as a lump sum in December.

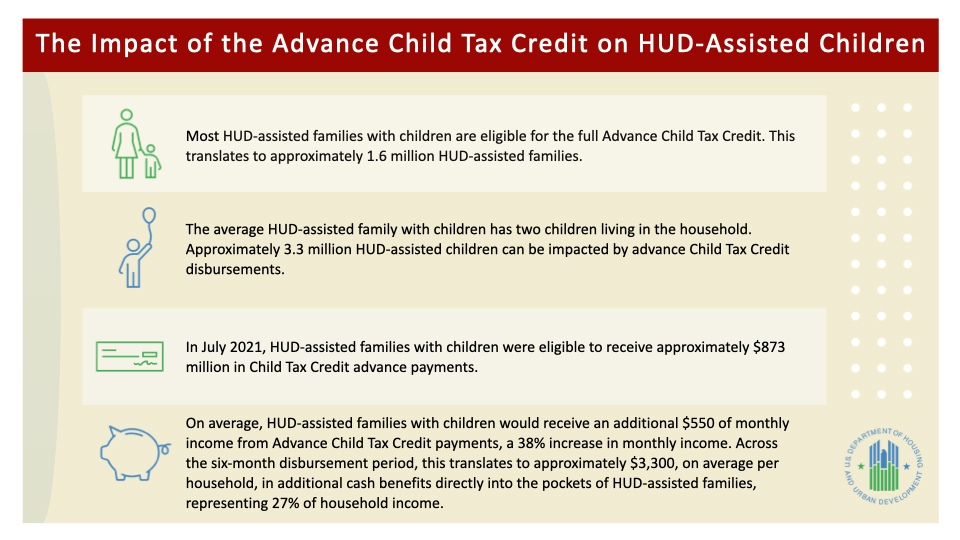

WASHINGTON The Internal Revenue. Thats potentially 1800 for each child up. About 36 million American families on July 15 will start receiving monthly checks from the IRS as part of the expanded Child Tax Credit.

Tax Filing Is Simple And Free For Those Who Qualify With TurboTax Free Edition. Who gets up to 1800 per child. See If You Qualify and File Today.

1011 PM CST December 10 2021. The final monthly child tax credit payment is due to go out on Wednesday. Child tax credit payment schedule 2022as such the future of the child tax credit advance payments scheme remains.

The advance Child Tax Credit payments disbursed by the IRS from July through December of 2021 were early payments from the IRS of 50 percent of the amount of the Child Tax Credit that the IRS estimated you may. The two remaining CTC advance payments under the American Rescue Plan that President Joe Biden signed into law in March are set to arrive on November. To get assistance filing for the Child Tax Credit.

The tax credit will go to individuals earning 75000 or less married couples making 150000 or less and a single parent filing as the head of. November 19 2021 saw the House Democrats pass the 175 trillion Build Back Better program which would see the enhanced Child Tax Credit payments remain in place for an additional year. Low-income families who signed up for the credits before the deadline will get six months of the payments on December 15 the Internal Revenue Service said.

Thats potentially 1800 for each child up. That would mean they would be getting in a total of up 1800 per child once the next installment is sent out on December 15. 1800 per Child Tax Credit But.

AS the last batch of child tax credit payments for the year hits bank accounts in the middle of the month some families will get up to 1800 for. Parents that have been collecting payments all MoreChild Tax Credit. But you are still able to receive the full amount of the 2021 Child Tax Credit.

Ad The 2021 advance was 50 of your child tax credit with the rest on the next years return.

Payments For The New 3 000 Child Tax Credit Start July 15 Here S What You Should Know Brinker Simpson

Child Tax Credit What We Do Community Advocates

Child Tax Credit 2022 How To Claim A Missed Payment Before Tax Deadline Marca

2021 Advanced Child Tax Credit What It Means For Your Family

Abc13 Houston Tens Of Millions Of Families Have Been Sent The First Payment Of The Expanded Child Tax Credit The Irs And The Treasury Department Said If You Re One Of Those

Child Tax Credit 2021 What To Do If You Didn T Get A Payment Or Got The Wrong Amount Cbs News

Liberty Tax Here S A Breakdown Of What To Expect With The 2021 Child Tax Credit Payment Schedule Sidenote If You Have A Baby In 2021 Your Newborn Will Count Toward The

The Advance Child Tax Credit An Opportunity For Hud Assisted Families With Children Hud User

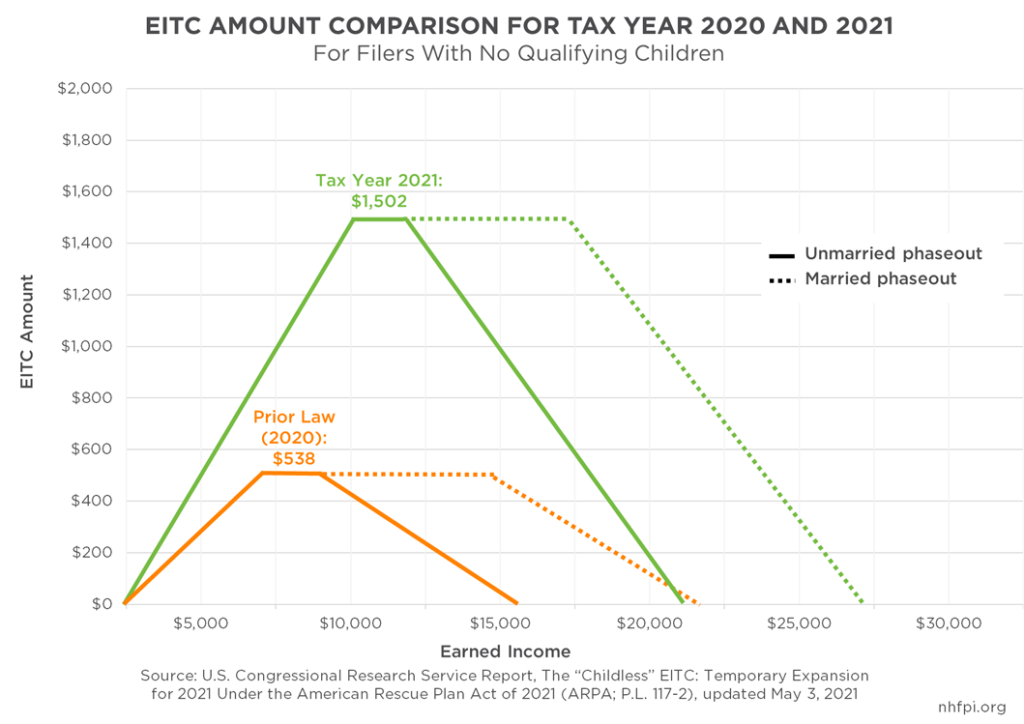

Expansions Of The Earned Income Tax Credit And Child Tax Credit In New Hampshire New Hampshire Fiscal Policy Institute

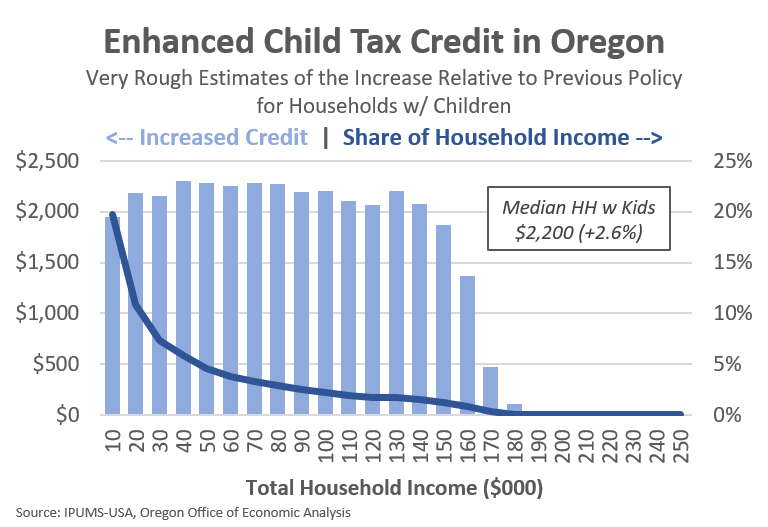

The Enhanced Child Tax Credit In Oregon Oregon Office Of Economic Analysis

Child Tax Credit Brought To You By Providers

2021 Child Tax Credit Here S Who Will Get Up To 1 800 Per Child In Cash And Who Will Need To Opt Out

Padden Cooper Cpa S Remember That The Child Tax Credit Is Optional If You Request It Now You Cannot Claim It Later On Your Taxes For More Help Call 609 953 1400 Childtaxcredits Taxes

Advance Child Tax Credit Payments Learn If You Need To Pay Money Back Cnet

The Advanceable Child Tax Credit In The American Rescue Plan Act Aaf

Child Tax Credit 2022 Are Ctc Payments Really Over Marca